Primary Bank Account For Upi Id Cannot Be Deleted Paytm

- How To Remove Upi Id From Paytm

- Primary Bank Account For Upi Id Cannot Be Deleted Paytm Phone

- How To Delete Paytm Upi Id

Launched in mid-2016 by the NPCI, the Unified Payments Interface (UPI) is slowly becoming the de facto mode for merchant and peer-to-peer transactions. And this is mainly because of its feature of allowing users to debit/credit easily and instantaneously, 24*7*365!

The adoption rate of UPI and ease of use speaks for itself. Check out these latest stats regarding UPI trends:

- Number of banks live on UPI have grown from 114 in April 2018 to 142 in July 2019

- Number of transactions have grown from 235 million in July 2018 to 822 million in July 2019.

Recipient may have deleted the UPI app 2. There is no active bank account linked to the recipients UPI ID 3. Recipient did not completed the eKYC 4. Recipient’s account may have reached the daily or monthly limit. Alternatively, you can also send money using the Bank account number and IFSC code. When you make payment by entering your Paytm UPI ID, the money will be deducted from your primary account. So if you have added two or more bank account in Paytm UPI then you can select any one account as primary. You can change or remove the primary bank account anytime. How To View/Check Paytm UPI Primary Account? Now Paytm merchants can link their multiple existing bank accounts with Paytm BHIM UPI ID and accept money in whichever account they wish. As per the National Payments Corporation of India (NPCI) guidelines, users can send up to Rs. 1 lakh a day using BHIM UPI; while there’s no receiving limit. To add a bank account to Google Pay, your bank must work with UPI. Your UPI ID is an address that identifies you on UPI (typically yourname@bankname). Find your UPI ID To find your UPI ID: Open Google Pay. In the top right, tap your photo. Tap Bank account. Tap the bank account whose UPI ID you want to view.

Therefore, today, we find all major apps embracing the UPI feature for payments, for the ease of their users and themselves. But to transact online through UPI, you need to have a unique UPI ID.

What is UPI ID?

UPI ID or the Virtual Payment Address (VPA) is a unique ID created to send or receive money through the UPI. Having a UPI ID (linked with a UPI-enabled bank) enables a user to receive money in his bank account without sharing his account number or other details. The user can simple share his UPI ID with the payer and receive payment directly in his bank account.

The UPI IDs may be different for different apps. For instance, Paytm created it in the format of yourphonenumber@paytm. In other apps, your UPI ID may differ according to the bank you have linked your account with, like yourname@bankname.

Here’s how you can check UPI ID in some of the most popular apps:

1. Google Pay

- Open the Google Pay app.

- In the top left corner, tap on your profile picture

- Click on “Bank accounts”

- Tap the bank account whose UPI ID you want to view.

- You will find all UPI IDs associated with that bank account under “UPI IDs”

2. BHIM

- Open the BHIM app.

- Click on “Profile” on the homepage

- You will find the UPI. It will be your registeredmobilenumber@upi.

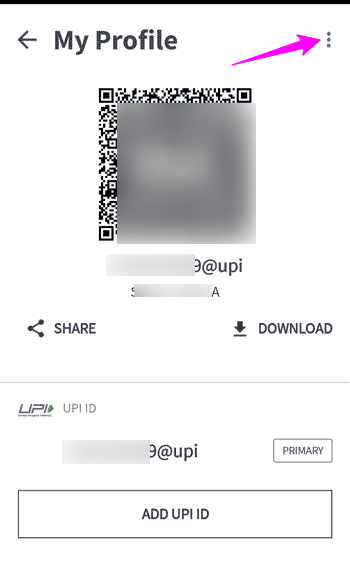

3. Paytm

- Open the Paytm app.

- Click on the “BHIM UPI” section at the topmost bar on the homepage.

- You will find your UPI ID in the first section of the page along with QR code. The UPI ID will be your phonenumber@paytm (as mentioned above)

4. Phone Pe

- Open the PhonePe app.

- In the top left corner, tap on your profile picture

- Click on “MY BHIM UPI ID” and you will find your unique ID. It will be your phonenumber@ybl.

5. Mobikwik

- Open the Mobikwik app.

- Tap the bank account whose UPI ID you want to view, at the top right corner. The ID will yourmobilenumber@ikwik

Note: You can create your own customized UPI IDs on all these apps.

.jpg/1280px-2012_torch_relay_day_13_A_lot_of_encouragement_by_West_Bank_Primary_School_(7309443210).jpg)

Conclusion

With UPI becoming a popular mode of payment amongst masses, it is important for businesses to offer UPI as a payment option to their customers, thus moving a step closer to being a “cash-less economy”. Accepting UPI payments across categories such as bill payments, grocery stores, and shopping is the need of the hour.

How To Remove Upi Id From Paytm

If you are a merchant or a service provider and want to give the best payment experience to your customers, then integrate with a UPI payment gateway like PayUmoney, which is robust, trusted and highly secure. PayUmoney’s payment gateway gives UPI as a payment option, other than credit card, debit card, and money wallets. With PayU, your business will be able to accept all payment modes that your customer is comfortable in using.

Primary Bank Account For Upi Id Cannot Be Deleted Paytm Phone

More Info on UPI:

UPI Insights

Accept Payments Using UPI

How To Delete Paytm Upi Id

- By participating in this offer, you agree to be legally bound by and abide by these terms & conditions. You confirm and acknowledge that you have read, understood and agreed to conform to these terms and conditions. If you do not agree to these terms & conditions, please do not participate in this offer.

- This offer is sponsored, organized and administered by One97 Communications Ltd, a company having its registered office at 1st Floor , Devika Tower, Nehru Place, New Delhi - 110019 and corporate office at B-121, Sector 5, Noida, UP 201301 One97 (hereinafter referred to as “One97” / “One97”).

- To participate in this offer, you should (i) have Paytm account/ wallet holder in India (ii) be of or above 18 years of age (iii) must be a resident of India;

- You acknowledge and agree that all copyright and trademarks and all other intellectual property rights in the SMS content, Website, WAP/App portal, and all material or content related to the offer shall remain, at all times, owned by One97 and/or their respective owners. All material and content contained in this WAP/App portal/Website is made available for your personal and non-commercial use only.

- Subject to any applicable law all warranties of any kind whatsoever, whether express or implied, are hereby expressly disclaimed by One97.

- In all matters relating the Cashback offer, the decision of One97 Communications Limited shall be final and binding in all respects

- We reserve the right to modify/change / withdraw all or any of the terms applicable to the Cashback offer, without assigning any reasons or without any prior intimation whatsoever.

- We reserve the right to disqualify any user from the benefit of the Cashback offer if any fraudulent activity is identified as being carried out for purpose of availing the benefits under the Cashback offer or by using Paytm website

- In no event, the entire liability of One97 Communications Limited for any dispute arising in connection with the Cashback offer shall exceed the cashback amount that the user is entitled to under the said offer.

- One97 Communications Limited in no event shall be liable for any incidental, consequential and financial losses/damages in any event whatsoever. You shall indemnify and keep indemnified One97 and their officers, directors, employees, customers, affiliates and agents harmless from and against any and all claims, losses, suits, proceedings, action, liabilities, damages, expenses and costs (including attorney’s fees and court costs) which One97 may incur, pay or become responsible for as a result of breach or alleged breach of your representations or obligations under these Terms and Conditions hereunder, any failure by you to comply with applicable law and any third party claim in respect of misuse of any information of a third party

- One97 Communications Limited shall not be liable for (i) any claims or grievances’/ defects/deficiencies solely attributable to the online partner’s to whom the payment is made/to be made (ii) any claims arising due to Force Majeure events or situations beyond its reasonable control.

- Tax liability, if any, will be borne by user

- This offer is being made purely on a “best effort” basis. Users are not bound in any manner to participate in this offer and any such participation is purely voluntary.

- Other Terms & Conditions and paytm policies apply.

- All issues / queries / complaints / grievances relating to the offer, if any, shall be addressed to customer support on- customer service (plz give address/ phone number/email id for complaints)

- All disputes shall be governed by laws of India and shall be subject to exclusive jurisdiction of the courts at Delhi